Lessons from the sharp drop in the price of oil. The sharp drop in crude oil prices from nearly $100 just a few months to below $65 a barrel has caught many economists by surprise. Just months ago many experts projected that oil would cross the $200 threshold in 2015. Economists who have been involved with projecting market trends got it dead wrong.

Case in point: In April 2009, Jeff Rubin, chief economist at CIBC World Markets, predicted that oil would cost $225 by 2012. He went further and wrote a best seller (“Why Your World Is About to Get a Whole Lot Smaller”) in 2009 arguing that a global peak oil supply would crimp growth and dramatically increase the price of oil. His argument was that high oil prices would reverse the trend of globalization and push the world towards local sourcing. So here is the problem: too many so called wise men or rather pop experts seek to profit from their prophecies and make a living by telling eager followers what the future will look like. Often they are wrong. But we have short memories and jump onto the next band wagon of prophecies. What can we learn from the debacle of projections about the price of oil?

Lesson 1: Experts can be dead wrong. Do your own homework.

Today, too many executives listen to pop experts who talk about drawing on best practices. In our opinion, a majority of business situations are influenced by a unique set of circumstances. To apply a singular vision across these situations or a standardized strategy is likely to dramatically escalate the risks associated with outcomes. Many experts projected that oil would continue to rise to over $200 in 2012. Hedge funds leased oil super tankers and parked them in the Atlantic hoping to see higher prices.

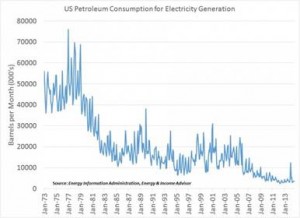

They assumed that if a majority of people saw a certain direction for oil, it was likely to come true. Markets can change dramatically over time. For example, US power plants cut their use of petroleum and other refined products by 50% in a decade from 50 million barrels per month in the 1970s to just 20 million barrels per month a decade later. The old adage holds true: the only certainty about the future is uncertainty. The fact is no one knows your business better than you do. Seek advice from at least five individuals before making a major decision. Once you have a diverse range of opinions, you will have greater visibility to a range of options which will allow you to prepare for different potential outcomes.

Lesson #2: Expect the unexpected. Complacency sets in with success.

In an interview with Arcus, Mr. Jim Leech, the ex. CEO of Ontario Teachers’ Pension Fund was asked about lessons he had learned from the financial crisis. His response was: “People let their guard down in the euphoria of good times. In a way, it’s back to basics. The type of things you have to do managing a financial institution through these times includes keeping your eye on liquidity. The last place you want to find yourself is in an illiquid market and having to sell assets to meet your obligations. Some institutions got themselves into a position where they had to sell blue chip stocks in because those where the only assets that could be sold.” The learning from the financial crisis and the recent downturn in the price of oil is that a sustained period of normalcy results in a significant level of complacency. We tend to mitigate the potential risks associated with inaction. What managers need to understand is that inaction is also a decision.

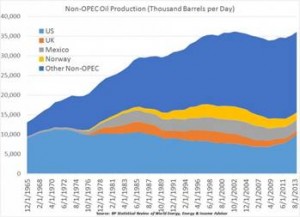

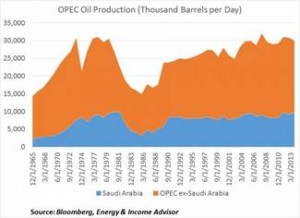

Let’s look at the production curve of oil. An unexpected event was the acceleration of horizontal drilling and discovery of the Bakken Oil Fields. American ingenuity kicked in and a profusion of oil was drilled quickly amounting to 30% of US oil consumption. OPEC has historically managed the price of oil by turning the spigot on or off to keep the price within a desired price band. However, Bakken changed the dynamics of the market quite rapidly. As a result, OPEC was taken aback by the rapidly diminishing market share it controlled. OPEC has had a vice like grip on oil prices in the past. For example, in the early eighties, OPEC lowered its oil output by a massive 12 million barrels per day helping to put a floor under oil prices.

Lesson #3: Plan for a range of outcomes and scenarios

One of the least used strategy tools is scenario planning. An Arcus survey of 120 CEOs earlier this year found that just 25% of respondents were satisfied with their strategic planning process. The primary reason for dissatisfaction was the lack of alignment of plans with actual results. They expressed concern about the value of strategic planning processes because these processes do not deliver the desired impact on the organization and its business objectives.

A primary driver of low impact and performance of strategic planning processes can be attributed to a rigid approach to planning. Most strategic planning processes are develop based on a set of assumptions and influencers that are at best a reflection of the situation at the time the plan is developed. It does not reflect changing circumstances or “what if” scenarios. As a result, as the year processes and new situations arise, the plan becomes increasingly redundant because the assumptions that the plan were based on no longer apply. As a result, the organization implements an outdated strategic plan diverges from the reality of the market and business environment and undermines the performance of the organization. An important missing piece is scenario planning. If organizational strategies are based on a range of variables and scenarios, business leaders would have augmented visibility into options available to address changing market environments. It will allow them to make quick changes to their plans.

A case in point is the price of oil. Very few investment companies envisaged the sharp drop in oil prices and as a result did not plan for the current scenario of severe compression of margins. Many organizations have planned for capital investments based on a price of $100+ a barrel. As a result, these companies are now experiencing losses as they continue to drill and extract oil at a high cost. Some companies even hedged against higher oil prices in the range of $120-$140 and as a result, have been severely impacted by the drop in the price of crude. The problem with these organizations is the lack of flexible strategic planning. If they had planned for a range of price scenarios of, say, $40 to $140, in increments of $20, they would have had a much better capacity to deal with the current situation.

Contact Arcus for a review and optimization of your 2015 strategy plan and organization design. Learn how it could transform your organization and accomplish your business goals. Please contact our Managing Partner, Merril Mascarenhas, by phone at +1 (416) 710-2727 or Email.

“Needless to say, there are many firms that provide research and strategy consulting services, but few can deliver the value demonstrated in performing the scope of analysis, strategies, product evaluations and practical recommendations. Your commitment and ease of doing business with your firm ensured that we had a sound basis to address our most challenging business decisions.”- Mr. Peter Flattery, CEO, Healthcare Insurance Reciprocal of Canada