View from the Top: Arcus Innovation Leaders Series. How business leaders use innovative approaches to shape their strategies.

An interview with Mr. Shaun Francis, Chairman and Chief Executive Officer, Medcan Health Management Inc.

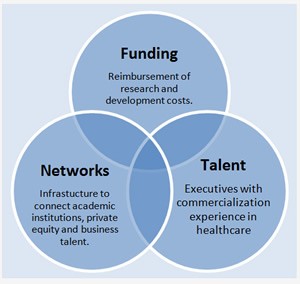

Mr. Francis argues that networks are required to connect the three key components that facilitate successful research and innovation: academic institutions with sources of funding, private equity, and commercialization talent with business experience.

Read the Arcus Innovation Leaders Report.

What does it take to innovate? The majority of executives say it involves achieving technological leadership, global presence and a comprehensive portfolio of patents that will enable the company to help define the major trends regarding products, systems and services, and to offer its customers important added value.

They say it helps to cut costs, increase sales and achieve higher earnings. But how does one come up with new solutions, and can innovations really be part of a strategy plan? Arcus’ multi-industry survey of senior executives found that of all the challenges companies face in this area, the biggest challenge is finding ways to create a “climate for innovation”.

As Arcus research indicates that to do so, you need to be surrounded by highly talented people, and you need to find a way to transmit your passion to them, so they will buy into your vision of the future, perform at the highest possible levels, and come up with innovative solutions to the challenges of achieving the vision. No surprise, then, that the topic of innovation has been gaining ground as CEOs seek to incorporate concepts like “a culture of innovation” into their assessments of a company’s long-term value.

Mr. Francis: The challenges with innovation in healthcare in Canada are three fold. First, Canada has a relatively small market to support the commercialization of healthcare innovation. To successfully bring innovation to market, we need to launch innovative Canadian products in larger markets like the US and Europe, which means that we often miss out on the financial return and reinvestment opportunities.

Second, the funding for the healthcare system in Canada is based on a service delivery model focused on treatment and not a preventive healthcare model, which provides little incentive for innovation in preventive healthcare.

Third, Canada has a monopoly payer/reimbursement model (government) which means funding for development costs to bring products to market is limited. Moreover, it seems to be a challenge to access funding from the government for innovation and most research in healthcare in Canada takes place at academic organizations.

“We need to see a concerted effort by the government to invest in research and development at universities with a focus on commercialization of these ideas.”

As a result of these challenges, the probability of commercialization of healthcare technologies in Canada is low, and if it does take place, it occurs at a relatively slower pace than in the US and Europe. New inventions are few and tend to be stifled by a small scale of reimbursement and funding capacity.

Gaps in the innovation value chain

Mr. Francis: One of the key challenges Canada faces is the lack of innovation networks. These networks connect the three key components that facilitate successful research and innovation: academic institutions with sources of funding, private equity, and commercialization talent with business experience.

In most hubs of innovation in the US, these three areas co-locate to accelerate the process of research, development and commercialization of healthcare products and services. We seem to be missing the infrastructure and funding to support these components in Canada, which must work in a linear progression to drive the innovation value chain from ideas to commercialization.

In Toronto, the Mars Centre is a laudable attempt to address the gap in infrastructure. However, more needs to be done to increase the pool of talent of senior executives with experience in commercialization of healthcare innovations, which requires a specialized combination of healthcare, technological and business expertise.

We need to think beyond the confines of the public sector for commercialization as it may not offer the right business environment to test the viability of innovative products and services, especially given the current funding and service delivery model. Innovation in Canadian healthcare is further stifled by limited interest from global private equity.

Commercialization of research

Mr. Francis: The three areas of opportunity to drive innovation in healthcare in Canada are infrastructure to support commercialization, superior talent and increased access to funding. We need to see a concerted effort by the government to invest in research and development at universities with a focus on commercialization of these ideas.

Second, we need to invest in world-class talent. The Perimeter Institute for Theoretical Physics in Waterloo is an excellent example of an international focal point of cutting-edge scientific research and educational outreach in foundational theoretical physics. The Institute has attracted talent from Europe and the US.

Our policies need to make it more attractive for young scientists to conduct research at Canadian organizations. We need to offer a persuasive value proposition to these scientists. Third, we need more funding behind innovation and ideas. We need a new funding model based on an endowment for R&D to accelerate targeted efforts in the area of commercialization of ideas.

“Our policies need to make it more attractive for young scientists to conduct research at Canadian organizations.”

Healthcare in Canada is based on a reimbursement model with limited acceptance of risk and experimentation. In contrast, the Medcan model offers an innovative delivery of preventive healthcare services.

We provide comprehensive, high quality care to executive teams, families and individuals who are interested in aggressively managing their health and wellbeing. It is a consumer directed medical service model based on preventive healthcare. The service is funded directly by the individual. This in itself is an innovation and unique in North America. For example, we have an alliance with the Johns Hopkins Hospital in Baltimore.

The organization has an excellent reputation as the expert in all aspects of research and medicine. They see us as an expert in direct to consumer services for preventive care. Our expertise is in superior customer service and efficient delivery of preventive care.

Medicare and Medcan’s offering

Mr. Francis: At the highest level, the key service we offer – a Comprehensive Health Assessment – is unique and innovative. Its purpose is to identify people who are at risk for developing disease, or to detect the early stages of disease in people who are asymptomatic. Medcan detects previously undiagnosed conditions in 20% of our clients.

Our Health Assessment goes far beyond what is offered in a traditional annual physical provided by a family doctor. Our Assessment is comprised of a battery of evidence-based tests – including ultrasound, x-ray, blood tests, and a 12-Lead Stress Electrocardiogram –provided at a single site within a four- hour period.

What also differentiates our Assessment is that Medcan physicians spend about an hour with each client and, because we have an onsite lab, physicians are able to discuss most test results with clients before they leave. Getting all of these tests done within four hours at a single site is in itself unique, and this means that clients avoid multiple visits to clinics that may take several weeks of testing in the Canadian healthcare system or even in the private systems in the U.S. We managed over 14,000 medical cases last year at a single location.

Medcan’s value proposition

Mr. Francis: A recent survey of senior executives on expectations from benefit plans indicated that 91% of CEOs and 83% of executives have a comprehensive health assessment as part of their benefits package. Another study of 1800 executives found that executives who had undergone comprehensive health assessments lost 45% fewer workdays to illness. Our value proposition focuses on highly customized and comprehensive health assessments based on each patient’s needs. The service goes beyond population trends and other broad indicators such as demographics. An increasing number of business executives and employers are interested in competitive benefits.