Work from Home is a challenge.

Only 12% of workers want to work from home full-time. Most want to return to the workplace, but with critical changes.

Work from home comes at a financial and psychological cost to employees who are shouldering expenses their employer used to cover. Tax breaks and reimbursements do not cover significant hidden costs.

For many employees, the impacts have depended greatly om whether they can work from home permanently or are they tethered to the workplace. Arcus research indicates that about 25 percent of the Canadian workforce can work remotely three to five days a week as effectively as they would in an office. If remote work took hold at that level, that would mean three to four times as many people would be working from home than before the pandemic which would have a dramatic impact on urban areas, transportation, and consumer spending.

Stay-at-home orders prompted by COVID-19 are creating a challenge for managers—including those in HR—at a time when many companies are implementing telework policies for the first time. Nearly three-fourths (71 percent) of employers are finding it difficult to adapt to telework as a way of doing business, according to recent research from the Society for Human Resource Management (SHRM).

Social Aspect of Work

Additionally, employers have found during the pandemic that although some tasks can be done remotely in a crisis, they are much more effectively done in person. These activities include coaching, counseling, and providing advice and feedback; building customer and colleague relationships; bringing new employees into a company; negotiating and making critical decisions; teaching and training; and work that benefits from collaboration, such as innovation, problem-solving, and creativity. If onboarding were to be done remotely, for instance, it would require significant rethinking of the activity to produce outcomes similar to those achieved in person.

For instance, while teaching has moved to remote work during the pandemic, parents and teachers agree that the quality of instruction and learning has suffered. Similarly, courtrooms have functioned remotely but are unlikely to remain online long term because of concerns about legal rights and equity—with some defendants lack adequate connectivity and concerns about missed nonverbal cues in video conferences.

Remote workers spend more on rent and housing costs

Work from Home Remote workers spend more on rent and housing costs than those who stay in the office — a gap that might add up to $1.5 billion or more if Canadian commuters don’t return. A new trend: boom in small apartment rentals that WFH employees use as offices.

Quantifying the economic impacts have focussed on what the move might cost (or save) employers, in terms of productivity or salaries or delves into the savings, in gas, time and carbon emissions, from Covid-altered commuting regimes.

Space Matters

A new working paper from the National Bureau of Economic Research says employees who find themselves without an office tend to increase their own spending — on more room. Or, more rooms. About 0.3 to 0.4 more rooms, to be exact.

Work from Home- Hidden costs

Hidden costs (National Bureau of Economic Research)

Prior to the pandemic, the expenditure share on housing was more than seven percent higher for remote households compared to similar non-remote households in the same commuting zone. Remote households’ higher housing expenditures arise from larger dwellings (more rooms) and a higher price per room.

Pre-COVID, households with remote workers were actually located in areas with above-average housing costs, and sorting within-commuting zone to suburban or rural areas was not economically meaningful. Using the pre-COVID distribution of locations, the study estimated how much additional pre-tax income would be necessary to compensate non-remote households for extra housing expenses arising from remote work in the absence of geographic mobility, and they compared this compensation to commercial office rents in major metro areas.

Excerpts:

“Prior to the pandemic, remote households were not locating in the least

expensive commuting zones; instead they were likely to be in places with some urban urban amenities. Reflecting this, we find that housing expenditure differences actually increase by about 40% for renters and 20% for owners when we omit commuting zone fixed effects.”

“Having established that the greater housing expenditure share among remote households is due to larger houses, we ask why remote work entails choosing more space. Two possibilities are: 1) Vehicles are complementary with commuting for non-remote households, and savings on vehicles allow remote households to consume more housing. 2) Additional space complements working at home, so remote households adjust housing consumption to accommodate home offices. After accounting for differences in the presence of vehicle for remote and nonremote households, we conclude that vehicles are insufficient to explain remote households’ greater housing expenses. The most plausible explanation for larger homes is that additional space is needed to accommodate remote work.”

There has been much recent popular discussion about the potential for firms to save office space costs by allowing remote work. The analysis shows that the increased cost of housing needed to support remote working will offset a significant portion of any savings on commercial real estate from remote work. This is because households with remote workers spend more of their income on housing to live in larger dwellings to accommodate having a home office.

Assuming that the incidence of who bears expenses for home office and corporate space is similar, the findings indicate that nominal cost savings to firms are overstated by about 30% relative to hybrid remote work where workers stay in the same local areas. Cost savings will possibly be greater for firms if households are allowed to sort to lower cost areas, but it is

yet to be determined whether frictions to mobility or preferences for places will limit this reallocation.

Work from Home- Eligible expenses

Eligible expenses include home office expenses as well as office supplies. Employees must separate the expenses between their employment use and non-employment (personal) use. Read more.

Where an employer requires the employee to pay for office supplies or certain phone expenses, the employee may be able to claim those expenses. The CRA’s website includes a comprehensive list of eligible and ineligible supplies. Eligible supplies do not need to be prorated like other home office expenses.

Home office expenses for employees

As an employee, you may be able to claim certain home office expenses (work-space-in-the-home expenses, office supplies, and certain phone expenses). This deduction is claimed on your personal income tax return. Deductions reduce the amount of income you pay tax on, so they reduce your overall income tax liability. Read more.

Tip for HR Leaders

Create an online cost/benefit dashboard for your employees.

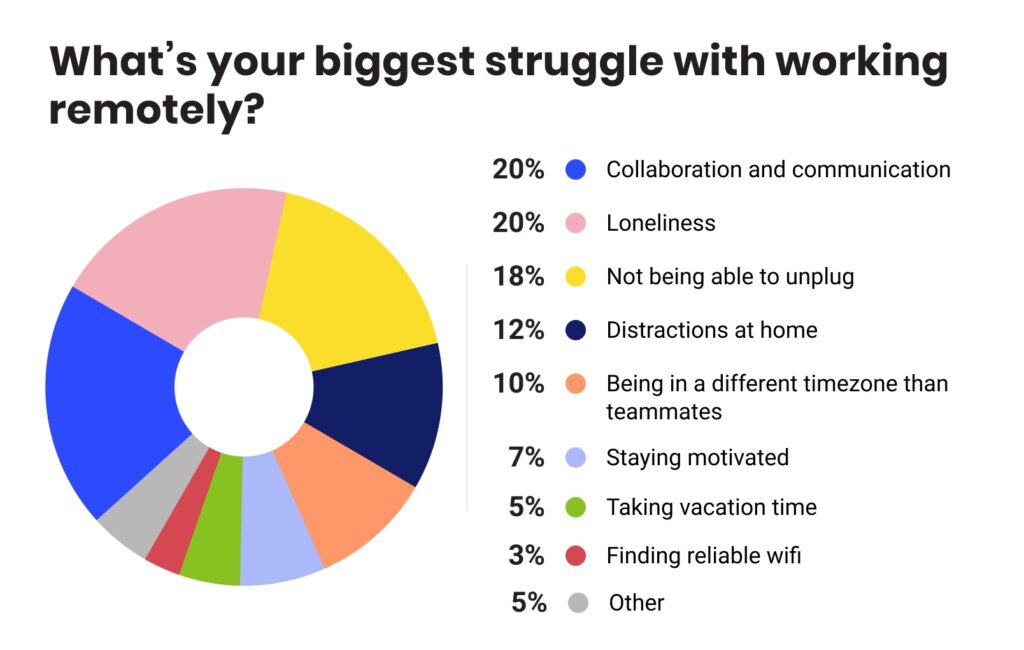

Managers need to be aware of how remote work may create feelings of isolation among team members. If staff are used to seeing their colleagues or customers every day, feelings of isolation can creep in remarkably quickly. This new remote working environment can also affect focus, a sense of team and creativity. It’s not something that is often talked about, but if HR needs to help teams stay healthy, happy and ultimately productive, they have to recognize and manage the high-stress environment that remote working can create for many people.

Service coverage

The variety, breadth, and depth of the projects where Arcus can be a resource are made unique by each client’s specific needs. By providing a very small sample of projects we’ve completed, we can help you understand how and when to use our services. Visit the links below to find out more about a specific problem or opportunity you would like to address.