Arcus reached out to senior Market Research Buyers for answers in our “B2B Innovation in Market Research” series. The initiative was launched in partnership with the Market Research and Intelligence Association of Canada (MRIA). The purpose of the Innovation Project is to share thoughts, ideas and approaches from Market Research Buyers about opportunities for innovation. Arcus organized three panel discussion and interviewed 35 market research buyers to understand the opportunities for performance improvements in social media monitoring and measurement.

Innovation in Market Research, Objectives:

- To identify attitudes and practices of marketers with regard to innovation in market research and insight mining in Canada.

- To identify methodologies, approaches and best practices in managing the innovation process.

- To collate outstanding examples of innovation in market research that have delivered measurable positive business results for brands.

Methodology

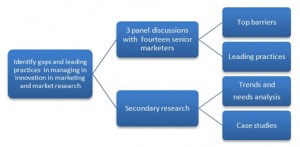

The project methodology included a combination of primary and secondary research. What are the most effective market and consumer insight mining tools that will help Market Research Buyers retain and acquire valuable customers in the future? It’s the fundamental question that any business has to ask. The answer to that question is perpetually changing and evolving.

A panel discussion and in-depth interviews with senior Market Research Buyers and marketers was organized for feedback on the topic of innovation in market research. The format for the discussions were open ended to help participants identify broad themes, gaps and opportunities that were impacting their organizations. In addition to the panel discussion, a series of in-depth interviews were conducted with senior Market Research Buyers for feedback on the themes identified in the panel discussion.

Participants included senior representatives from Market Research Buyers such as Scotiabank, Microsoft, Domtar, Canadian Institute of Chartered Accountants, Canadian Medical Association, Whirlpool, Hydro One, McCain Foods, Sobeys, Sasktel, Kellogg, Bell, RBC, Unilever and Ivanhoe Cambridge Inc., augmented by over 2,400 interviews with senior executives in 36 industries by Arcus Group.

This report on Social Media is the first in a series of five papers that will highlight areas for innovation and change that were identified by Market Research Buyers in our discussions. The four other themes identified were respondent recruitment, quality of insights, strategic direction and project management.

The Impact of Social Media

Social media – “It’s like drinking from a fire hose”

Online and social media are enabling marketers to scrutinize their dollars more closely as they provide more measurable data than traditional media. There is an expectation of superior outcomes and higher visibility regarding research results when deploying digital media research tools. But is that truly the case?

“Too often, the focus of traditional web analytics tools is purely on data collection and delivery.”

While social media research firms often generate significant volumes of consumer data, the impression is that the data comes at marketing departments as a flood. More than one respondent used the phrase “like drinking from a fire hose” to describe the challenges they face with managing the deluge of data. According to a majority of Market Research Buyers, too often the focus of traditional web analytics tools is purely on data collection and delivery rather than on developing an understanding of the channel and how activity in that channel relates to actual market behaviour.

New vs. Old

Market Research Buyers were clear that social media is an essential new tool but do not yet discount older methods as obsolete. The perception is that current standards and measurement of social media engagement are not yet sufficiently developed to be solely relied upon for market research purposes. While organizations are engaging in social media market research, a few voiced concerns that they are being offered unproven pilots for initiatives and are paying for the market research vendors to prove their value (or not).

Market Research Buyers do not want the tool development and evaluation to come solely at their cost. One buyer pointed out that his company had done three projects in the past year and in not one of the cases were the vendor’s projections in line with the actual outcomes. The feeling is that social media research and analytics have not yet delivered proven results and that expertise needs to be developed before the research tools are presented to Market Research Buyers, not during or after the engagement. When there are limited budget dollars, there’s a reluctance to devote resources to unproven tools. Some Market Research Buyers acknowledge there is some inertia to try new tools – they are intrigued but not enough to pursue it within their existing plans until more is known.

Monitoring vs. Analysis

Social media is also seen as an area where it is perceived that a lot of the work and measurement can be done in-house. There are a variety of free or inexpensive Twitter tracking programs, for example. The value-add is in providing analysis and presenting information in a broader context. This ties into another commonly voiced perception, the thought that social media is free although, in fact, it’s not.

“The value-add is in providing analysis and presenting information in a broader context.”

There’s also a whole area of concern about the need for more scrutiny and more measurability of ROI. The use of and monitoring of social media is incredibly important because it changes the conversation between organizations and their target audiences. Market Research Buyers think that it is relatively simple to run a social campaign and that free media gets people talking. That is not really true. One respondent described it as three pillars: paid media, which often ignites the conversation; owned media, with their own brand; and then earned media, which is uninitiated positive word of mouth.

Our interviews brought out the idea that social media allows a move from listening to customer feedback to actually conversing with them and engaging them and building a relationship. While respondents had doubts about existing social media tracking results and their application to business planning, they respect the power of deploying social media strategies in their marketing plans.

Keeping up with Emerging Technologies

Another concern that was raised in the interviews related to investing in social media research because the field is developing so rapidly and there is a continual advent of new Market Research Vendors. There is some worry that research tools and metrics are not keeping pace with changes in the market and technologies. Some Market Research Buyers say that once the consumer target and how best to reach them are identified, by the time the recurrent research data come in, the best platform to reach them may have changed.

Market Research Buyers also express a keen interest in exploring social media offerings from technology companies that may not qualify as market research firms, especially in the area of social media monitoring. Monitoring tools related to blog research are driving this trend. Buyers say that the advancements in monitoring technologies have accelerated to a point where insights related to associations between phrases and sentiment are more reliable. The emerging technologies offer new opportunities in four areas – Monitoring & Listening, Promoting & Sharing, Gathering Feedback and Collaboration.

Social Media Monitoring vs. Other Qualitative Research Methodologies

There is a growing acceptance of the use of social media monitoring to supplement other qualitative research methodologies or even replace focus groups. One marketer in the consumer packaged goods sector used social media monitoring and said that the results surpassed their expectations with regard to researching words that were associated with the brand, and were able to pull together narratives that spoke to what the target market felt they needed in a particular product category.

“Social media monitoring tools are making inroads for ongoing feedback from clusters of consumers to engage audiences ‘where they live’.”

Social media monitoring tools are also making inroads for ongoing feedback from clusters of consumers to engage audiences “where they live”. Buyers say that being relevant and using tools the audience is comfortable with is more important than using tools that market researchers are necessarily comfortable with.

When it comes to measuring social media, an immature but rapidly evolving field, it is critical to embed tracing hooks throughout the customer experience and use those to track behaviour and response. This can be done both qualitatively (number of discussion topics, apparent sentiment) and quantitatively (reach, site engagement).

Translating Insights into Strategies

Consumers are more focused on how they relate to brands and communicate with their social network. They are able to access a lot of information and use it to form an opinion. The type of media that they use to draw the information may drive their decisions. So how does a marketer ensure they are getting information that is of sufficient quality to allow them to make decisions? Data alone is not enough; to be meaningful, data needs to be accompanied by deep analysis.

A more nuanced approach looks at the data and at external factors that may have come into play and assist in translating insights into actionable business strategies. Quantities of data do not compensate for a lack of quality. In fact, too much data is seen as problematic as it can lead to decision paralysis while the data is being considered. As one market research buyer put it, “the right data helps inform decisions; it helps to manage risk but does not eliminate it”.

Generational Culture Shift

There is a growing need to connect, and stay connected, all the time with consumers. Social media is following along a cultural shift with an offering of ongoing, real time research feedback. The demographic shift is contributing to this trend as younger marketers take a different approach to consuming information and management styles. As waves of Canadians retire, existing ways of doing business are going to change. Technology certainly plays a big role – it redefines how businesses operate and how they interact with their vendors, strategic partners as well as their customers.

With the cultural shift, marketers are seeing fragmented markets and that means that research needs to target narrower interpretations of segments and represent these new clusters with an increasingly complex mix of tools to draw customer insights. Even publishers find it challenging to deliver brand advertising messages to niche markets in a measurable way, even through the online space.

Marketers need to customize how they gather their information to cover varying demographics. The most successful business models are looking into forming a new value chain of research through partnerships – a manufacturer with their retail partners, for example. Customers are more educated about products and how to research them so brand alone does not have the same impact that it did at one time.

Please contact Merril Mascarenhas, Managing Partner at Arcus Consulting Group at (416) 710-2727 or by email to learn more about how our insights from over 2000 C-level executives can strengthen your growth, organization and operational strategies.

Read the Arcus Innovation Leaders Report.